08.2025 Life Guide

Retirement Trust and Intentional Guardianship for Elderly Care

Far Eastern International Bank / Jian Finland

Taiwan has entered a super aging society by 2025, with the population of dementia continuing to rise, and the methods of fraud groups constantly innovating and becoming increasingly rampant. Everyone should think early about their elderly care situation and property protection measures. In this issue of 'Finance Column', we take money security trusts as an example to explore how to enable elders to enjoy a healthy and happy retirement life.

Taiwan has entered a super aging society by 2025, with the population of dementia continuing to rise, and the methods of fraud groups constantly innovating and becoming increasingly rampant. Everyone should think early about their elderly care situation and property protection measures. In this issue of 'Finance Column', we take money security trusts as an example to explore how to enable elders to enjoy a healthy and happy retirement life.An elderly care trust is one of the solutions for protecting assets in an aging society

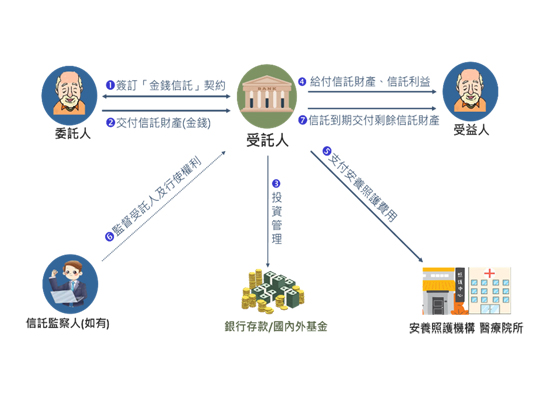

An elderly care trust is a property management system aimed at providing elderly care, with the functions of asset protection and dedicated funds. A trust contract is signed between the principal (property provider) and a bank (hereinafter referred to as the bank) engaged in trust business, and the property (trust property) is delivered. At the same time, it is agreed to transfer the trust property to the beneficiary (the person who wants to take care of it) on a regular or irregular basis. Through trust arrangements, it is possible to avoid unexpected situations where the settlor is unable to handle the property.

Figure 1: Process for Handling Anyang Trust

Elderly people are most concerned about insufficient savings, illness without care, lack of companionship during normal times, inability to allocate family assets in time, causing disputes among children, and becoming targets of fraud groups. Children may explain the concept of "taking care of themselves first and then taking care of their families" to their elders, and ask them to sign a self beneficial care trust with the bank (both the trustor and beneficiary are elders) when they are aware. They should arrange in advance the management and use of the trust property, including whether they can invest in financial products, the conditions for contract changes and termination, as well as the payable expense items and amounts, such as monthly living expenses, medical expenses, care institution fees, nursing expenses, etc. At the same time, find a trustworthy person to serve as a trust supervisor (family, friends, or social welfare organizations can all be) to safeguard the interests of elders and exercise relevant trust benefits on their behalf. At the same time, supervise whether the bank manages the property in accordance with the provisions of the trust agreement. If the principal is concerned about their children being unfilial or entrusted to someone other than themselves, they can stipulate in the contract that no one can terminate the trust agreement when they are ordered to assist in the declaration or guardianship declaration. After a hundred years, if there are still unused trust assets, they will be incorporated into the inheritance of elders and distributed to heirs or designated beneficiaries.

Elderly people are most concerned about insufficient savings, illness without care, lack of companionship during normal times, inability to allocate family assets in time, causing disputes among children, and becoming targets of fraud groups. Children may explain the concept of "taking care of themselves first and then taking care of their families" to their elders, and ask them to sign a self beneficial care trust with the bank (both the trustor and beneficiary are elders) when they are aware. They should arrange in advance the management and use of the trust property, including whether they can invest in financial products, the conditions for contract changes and termination, as well as the payable expense items and amounts, such as monthly living expenses, medical expenses, care institution fees, nursing expenses, etc. At the same time, find a trustworthy person to serve as a trust supervisor (family, friends, or social welfare organizations can all be) to safeguard the interests of elders and exercise relevant trust benefits on their behalf. At the same time, supervise whether the bank manages the property in accordance with the provisions of the trust agreement. If the principal is concerned about their children being unfilial or entrusted to someone other than themselves, they can stipulate in the contract that no one can terminate the trust agreement when they are ordered to assist in the declaration or guardianship declaration. After a hundred years, if there are still unused trust assets, they will be incorporated into the inheritance of elders and distributed to heirs or designated beneficiaries.After signing the trust agreement for elderly care, the bank will open a personal dedicated trust account for each principal to store the money delivered by the principal. In the future, payment of various fees must be confirmed by the bank that the contents of receipts, vouchers, or proof documents are correct before payment can be made on behalf of the principal to ensure that every penny is used for the elderly. If you want to withdraw cash, you need to fill out the bank's prescribed form and cannot withdraw it through ATM. In short, trust is like a lock, and an additional procedure can reduce the chances of property being abused or defrauded.

In recent years, many people have become familiar with "safety trusts", but many are not very accepting of having to pay management fees when depositing money in banks. In order to encourage the public to plan ahead, banks have launched "pre opening type elderly care trusts". The trustee only needs to pay the signing fee first, and the trust management fee will only be calculated and paid when the elderly care fee payment is initiated. If the future property management and utilization method has not been decided yet, the trustee can also apply to the bank for contract amendment or re signing when there is a complete plan in the future.

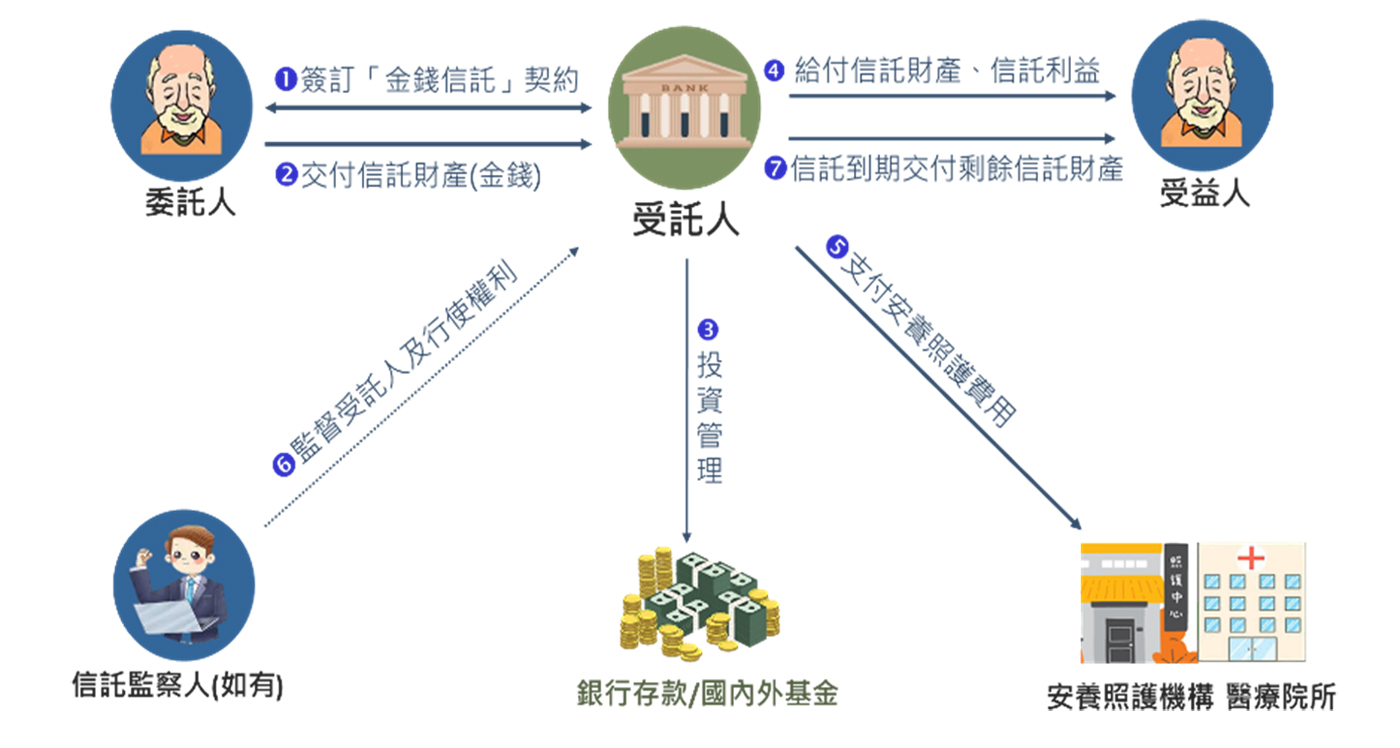

I will decide on the guardianship system for my own future

When a person loses their ability to act, in addition to property management, they also need assistance in daily life and medical care. If we can first choose future caregivers and property management methods, on the one hand, we can decide on our own care methods, and on the other hand, it can also reduce the pressure and disputes on our children. In 2019, the Civil Code added the "voluntary guardianship system", which means that the public (the appointed person) agrees in advance with the appointed person they have chosen through a contract before losing their capacity to act. When there is a "restriction on the capacity to express their will" in accordance with the provisions of the Civil Code, the judge will designate the appointed person as the guardian. In short, this is a system that allows for pre planned care and maintenance, while also having the function of protecting property.

The appointing party needs to first find a trustworthy person (the appointed person), and both parties shall follow the designated guardianship process, sign the designated guardianship contract, and complete notarization. The content of the contract appointment includes: the scope of the appointed affairs, the method of property management, the scope of the appointed person's duties, etc. Among them, the appointed affairs should at least include the following items to achieve the purpose of taking care of the principal:

1. Arrange for the care life, medical treatment, and payment of various expenses of the appointed person.

2. Review and signing of medical contracts, hospitalization contracts, care contracts, and accommodation contracts for care institutions.

3. Keep documents and materials related to property.

4. Apply for and receive various retirement benefits, insurance payments, allowances, and subsidies on behalf of the appointed person.

5. Issue a list of the assets of the appointed person.

6. Assist the appointee in handling inheritance matters and legal affairs.

7. Other agreed matters, such as arranging meetings with relatives and friends, receiving letters, etc.

The appointee can agree on one or more assignees to share the caregiving work and achieve mutual supervision. Except for the duties agreed to be performed separately, all other duties are jointly performed by all guardians. If you are worried about not having enough money to take care of yourself in the future, you can refer to the guardianship appointment contract, which stipulates that the appointed person can dispose of the real estate on behalf of the principal without the permission of the court before fulfilling their duty of care as a kind manager, in order to support the principal's living and care expenses. Of course, over time, the thoughts of the principal and the suitability of the appointed person may change. As long as the court rules on the declaration of guardianship, the principal or the appointed person can withdraw the intended guardianship application at any time. However, it should also be noted that if there are duplicate agreements resulting in two or more versions, according to civil law, it shall be deemed that the principal has withdrawn the previous intended guardianship contract.

Figure 2: Procedure for Handling Intentional Guardianship (Source: Legal Department)

Using Anxin Trust and Designated Guardianship to Schedule Life and Protect Wealth

Using Anxin Trust and Designated Guardianship to Schedule Life and Protect WealthCommon questions about nursing trusts and voluntary guardianship, such as: "Both nursing trusts and voluntary guardianship have the functions of property protection and assisting in paying various living expenses. Can I only handle one?" and "I already have a voluntary guardian, do I still need to set up a trust supervisor for nursing trusts

Firstly, there is no conflict between the trust and the designated guardian. Property management is carried out by the bank, while life care is carried out by the designated guardian, achieving the advantage of mutual supervision and avoiding conflicts of interest as the person in charge of the money does not care, and the person in charge does not care about the money. As for whether the designated guardian and trust supervisor are held by different individuals, it depends on the complexity and professionalism of the affairs that the elders require assistance from others. If the elder is the manager of the company and delivers the securities held by him/her to a trust, when the elder is ruled to have guardianship declared, in addition to removing the chairman position, the management and share handling of the company also need to be handled by specific individuals or professionals. Therefore, it is necessary to consider whether multiple trusted relatives, friends, or charitable organizations can be found.

Regardless of whether a trust agreement is signed first or a guardian is requested in advance, it is important to note that the provisions of both agreements should be coordinated. At least in the guardianship appointment agreement, it should be stipulated that the guardian can act on behalf of the principal to exercise the rights of the trust, and there should be no conflict in the management and use of property.

Retirement trusts are not exclusive to the elderly. Taking advantage of one's youth and being prepared, one can apply for retirement trusts and designated guardianship in advance, and arrange their future retirement life and wealth management in order to enjoy freedom and autonomy. Welcome to click on the single episode link, scan the QR code, and listen to the podcast channel S3-EP2 "Inheriting Happiness with Trust" on "Ten Music without Money". Learn more about the functions of trust and share exciting case studies to prepare for your own and your family's future.

Figure 3: Ten Joys Without Money in Life - Inheriting Happiness through Trust

#