12.2025 Life Guide

Minimum wage increase in 2026

Far Eastern New Century Corporation / Wang Yuxuan

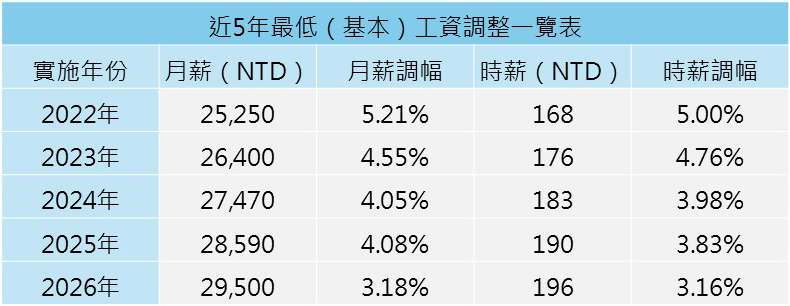

In order to ensure the basic living income of workers, Taiwan will raise the minimum wage from January 1, 2026: the monthly salary will be increased from the current NTD28590 to NTD29500; The hourly wage has been increased from NTD190 to NTD196, with an adjustment of approximately 3.18%. This issue of 'Legal Column' gathers five common Q&A sessions to help you understand your own rights and interests.

In order to ensure the basic living income of workers, Taiwan will raise the minimum wage from January 1, 2026: the monthly salary will be increased from the current NTD28590 to NTD29500; The hourly wage has been increased from NTD190 to NTD196, with an adjustment of approximately 3.18%. This issue of 'Legal Column' gathers five common Q&A sessions to help you understand your own rights and interests.Q1: What is the basis for adjusting the minimum wage?

A1: Every year, 10 indicators including "changes in consumer and producer prices", "annual increase rate of average labor wages", "labor productivity index", and "minimum living expenses" are comprehensively reviewed, hoping to ensure the basic living standards of low wage workers, narrow the gap between wages and prices, and promote domestic demand economy and labor market stability.

Q2: What is' minimum wage '? What salary items or bonuses (allowances) can be included in the calculation of "minimum wage"?

A2: Minimum wage refers to the remuneration received by workers for their work during "normal working hours", excluding wages for extended working hours and wages for rest days, holidays, and holiday work. Any item that meets the definition of "wage" under the Labor Standards Law, including wages, salaries, bonuses, allowances, and any other nominal regular payments, can be included. Therefore, wages are not limited to the base salary, and regardless of the employer's name, any remuneration received for work belongs to the category of "wages".

Q3: In the salary list I received, it appears that the base salary is lower than the minimum wage. Is the employer violating the law?

A3: Not necessarily. The law guarantees that the 'regular salary' shall not be lower than the minimum wage, rather than just looking at the base salary. The total of salary, fixed allowances, or fixed bonuses (such as meal allowances, transportation allowances, monthly performance or attendance bonuses, etc.) is the basis for judgment. If the total is still below the "minimum wage" standard, it is considered illegal.

Q4: Can the salary be lower than the minimum wage after mutual agreement between labor and management? If violated, are there any penalties that can be imposed on the employer?

A4: No, it's not possible. The minimum wage is the most basic wage guarantee threshold for workers, and both labor and management cannot agree on a wage lower than the minimum wage. According to Article 17 of the Minimum Wage Law, employers who violate the law may be fined NTD 20000 to NTD 1 million, with a maximum fine of NTD 1.5 million. The competent authority will also announce the information of the public institution and set a deadline for improvement.

Q5: Can I request to switch to an hourly wage system if the hourly wage converted from a monthly salary system is lower than the statutory hourly wage?

A5: It's not possible. For example, Xiaomei's monthly salary is the minimum wage NTD 29500, with 8 days off per month. When converted to an average hourly wage of NTD 168 (NTD 29500 ÷ 22 working days ÷ 8 hours), it is lower than the statutory hourly wage NTD 196. According to Article 4 and Article 5 of the Minimum Wage Law, the minimum wage shall be determined by the labor contract signed by both the employer and the employee, and the calculation method of salary shall be agreed upon in advance to adopt the "monthly salary system" or "hourly salary system", and shall not be adjusted arbitrarily. Therefore, if Xiaomei has agreed with her employer to adopt a "monthly salary system", the salary standard will be judged based on whether the monthly salary meets the minimum wage.

The following is a summary of the minimum wage adjustments in the past 5 years for your reference.

(Source: Ministry of Labor, National Regulations Database, Labor Law Query System, Labor Insurance Bureau)

#