07.2021 Life Guide

After earning the price difference, is it necessary to wait for the dividend?

Investment Research Department of Oriental Petrochemical (Taiwan) / Xie Yifan, Lin Xiaohan

In the first half of this year, Taiwan stock market once broke the seven thousand mark, attracting many small investors to invest in the stock market. But you know what? In addition to buying and selling stocks, you can earn spread profits, and you can also earn dividends through ex dividend! This issue of "finance column" will show you how to use ex dividend to accumulate wealth for yourself!

In the first half of this year, Taiwan stock market once broke the seven thousand mark, attracting many small investors to invest in the stock market. But you know what? In addition to buying and selling stocks, you can earn spread profits, and you can also earn dividends through ex dividend! This issue of "finance column" will show you how to use ex dividend to accumulate wealth for yourself!What is ex dividend?

"Except" means "distribution"; except "right" means "stock"; except "interest" means "cash". When we buy stocks and become shareholders of the company, the company will give back the earnings of last year to shareholders. The dividends (including stocks and cash) received by shareholders are "investment returns".

How to participate in ex dividend?

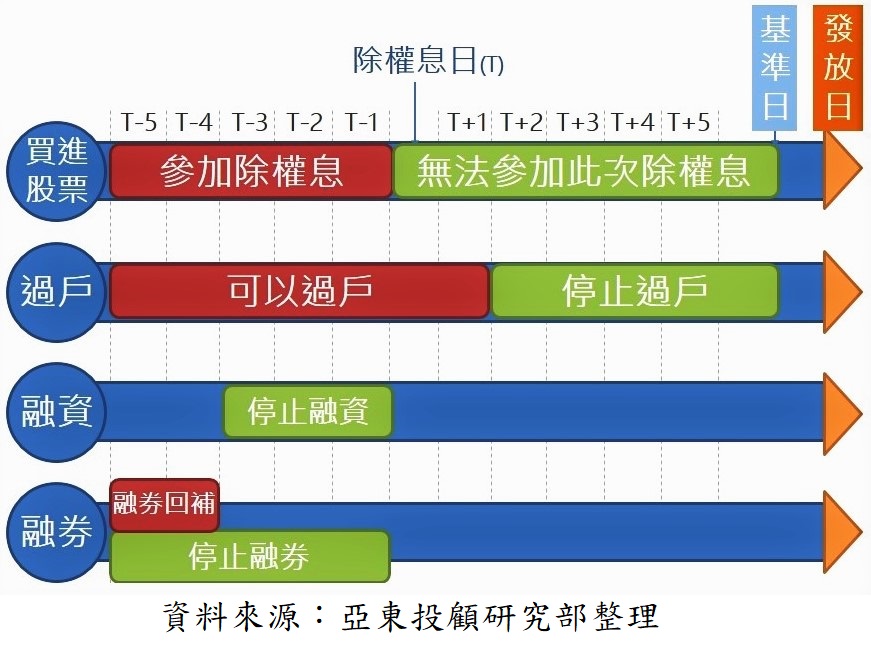

As long as investors buy or hold shares of the company one day before the ex dividend date, they can participate in ex dividend and receive "cash dividend" or "stock dividend".

Index high-grade, should not participate in ex dividend?

Index high-grade, should not participate in ex dividend?In 2020, the total net profit after tax of Taiwan's publicly quoted entity is about 2.4 trillion yuan, with an annual growth of 21%. It is expected that the total amount of cash dividends distributed in 2021 will be 1.5 trillion yuan to 1.6 trillion yuan, breaking through a record high. The yield is expected to break through 3%, ranking third in the global stock market, which is attractive compared with fixed deposit or other investment targets.

In addition, in 2021, with a sharp rebound in global GDP and a sharp growth in Taiwan's exports, it is expected that the profit of Taiwan's publicly quoted entity will grow by about 20% this year. By 2022, interest distribution will have more opportunities to reach a new high, and in the long run, it will be able to obtain stable returns.

However, in addition to the tax burden, the stability of interest distribution and the speed of filling in the right interest are the key factors to decide whether or not to participate in the ex right interest. As for the stock market index, it is not the key.

Which investors are suitable to participate in ex dividend?

1. Cungu family

It is hoped that the dividend will accumulate for a long time and create wealth through the effect of compound interest. Therefore, stable and high yield stocks are the first choice of depositors, but we need to pay attention to whether the annual stable interest distribution can be maintained behind the high yield.

2. Investors who pursue stable returns and low risks

First of all, companies that distribute higher dividends and yields every year can participate in ex dividend if they have high probability of filling in interest and fast filling in interest in the past. Once they fill in interest, they can be sold to obtain rewards and reduce risks.

3. Low income tax burden

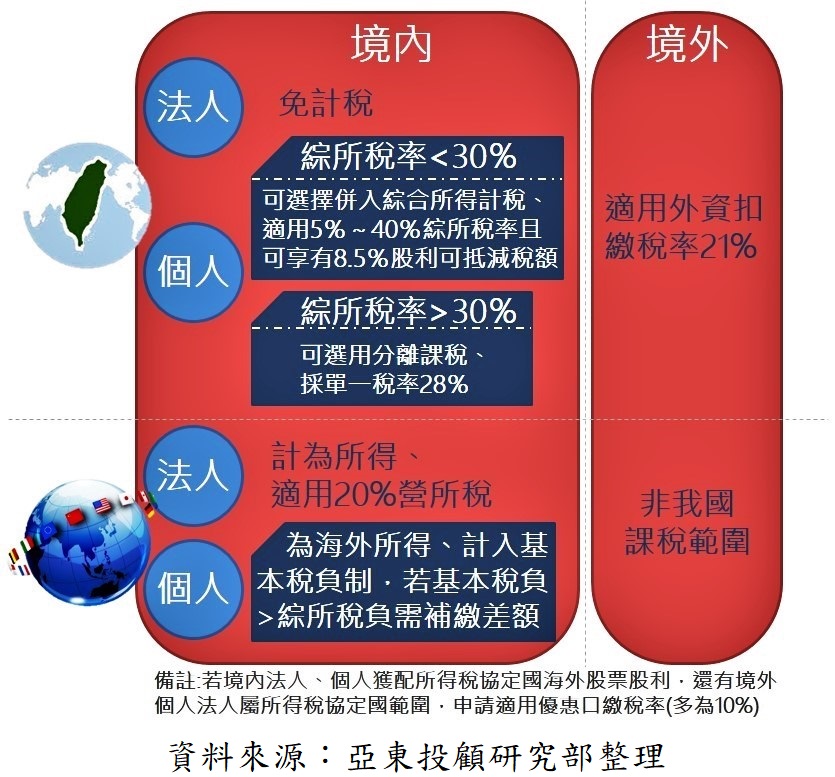

Dividend income is taxed under the "alternative system", with a single tax rate of 28% and separate taxation, or the dividend income is consolidated into personal income, with an 8.5% tax credit, but the upper limit for each applicant is 80000 yuan.

Generally speaking, if the income tax rate is less than 20%, it is better to choose the dividend income consolidated tax and use the 8.5% tax credit; For those whose income tax rate is 30% or 40%, it is better to calculate the tax at 28% separately.

How to choose the ex dividend target?

From the end of March 2020 to the beginning of 2021, this wave of Taiwan stock index has reached a record high all the way. In addition to the rebound of the economic cycle stimulated by monetary and fiscal policies reflecting the global expansion, it is also crucial for Taiwan's manufacturers to improve their status greatly under the impact of Sino US trade war and epidemic situation.

In the process of Taiwan stock's new high, the main driving force comes from semiconductor and related technology stocks. The benefited terminals include 5g demand explosion, electric vehicles, and the new normal demand brought by the new life style after the epidemic. Therefore, in addition to selecting the right industry, we should try to avoid "companies with declining profits" and choose from companies with growing profits or at least stable profits.

1. Investors who like technology stocks: they can start from the major manufacturers in the lower reaches of the electronics industry, which are relatively stable and have an average yield of more than 5% in the past, which is better than the overall yield of Taiwan stocks. If you are not sure about stock selection, many ETFs now have interest distribution. Although the yield is low, it is relatively stable.

2. The favorite financial stocks of depositors: in the past few years, the interest rate spread continued to decline under the influence of monetary easing, and the bank profits were compressed. However, due to the prosperity of the stock market, the profit of financial stocks can still maintain a certain level, and the interest distribution is still stable. In the long run, it is still the target of steady profit and stable interest distribution.

Ex dividend risk

1. The ability to fill in rights and interests

Observation The performance of a company in filling in the right and interest over the years, that is, when the stock price falls after the ex right interest, the shorter the time it takes to return to the price before the ex right interest, or even to a higher price, represents the stronger ability of the company to fill in the right and interest, which is suitable for investors to participate in the ex right interest and receive dividends. On the contrary, if the past record of filling in rights and interests is not good, or even the industrial structure is not right, and continues to go down, the profit volatility is large, the interest distribution is unstable, and it is possible to earn dividends and compensate for the price difference, we should try our best to avoid it.

2. Pay attention to tax issues when participating in ex dividend

If the income tax rate is less than 30%, the dividend can be deducted by 8.5%, and the upper limit of each applicant is 80000 (that is, the upper limit of dividend is 940000); For those with high income tax rate (> 30%), dividends are taxed separately, and the tax rate is 28%; In contrast, the high-income group is not suitable to participate in ex dividend. It is suggested to earn capital gains from ex dividend, or buy after ex dividend to earn interest.