03.2024 Life Guide

How to get a good mortgage when the loan is full?

Far Eastern International Bank / Wu Ruimin

Xiaoming and Xiaohua are college buddies. After many years in society, the two have been buying houses one after another recently. Xiao Ming works in the financial industry in the center of Taipei, so he bought a nearby two bedroom layout, a small but relatively convenient medieval house, and successfully obtained an 85% mortgage rate; Xiaohua established a cultural and creative studio and, in search of writing inspiration, bought a transparent house located in the suburbs of Hsinchu, with a mortgage rate of only 70%. Why is there a gap in the loan ratio? How to increase the loan ratio? In this issue of "Finance Column", we will share with you the secrets behind it.

Xiaoming and Xiaohua are college buddies. After many years in society, the two have been buying houses one after another recently. Xiao Ming works in the financial industry in the center of Taipei, so he bought a nearby two bedroom layout, a small but relatively convenient medieval house, and successfully obtained an 85% mortgage rate; Xiaohua established a cultural and creative studio and, in search of writing inspiration, bought a transparent house located in the suburbs of Hsinchu, with a mortgage rate of only 70%. Why is there a gap in the loan ratio? How to increase the loan ratio? In this issue of "Finance Column", we will share with you the secrets behind it.1、 Understanding the percentage of mortgage payments

When banks receive housing loan applications from the public, they will evaluate the value of the property and calculate the "appraisal price". Based on the applicant's professional income, assets and financial resources, credit records, and location of the collateral, a comprehensive evaluation will be conducted to determine the loan amount (i.e. the "loan amount"). The result of dividing the "loan amount" by the "appraisal price" is the "housing loan percentage". For example, if the bank estimates a house with a price of NTD 10 million (if it is not a purchase or sale item, the land value-added tax must be deducted), and the loan amount is NTD 8 million, then the loan percentage is 80%.

2、 The influencing factors of housing loan success rate

1. Housing location selection: There are many factors that affect the success rate of mortgage loans, among which the housing location is the first. In the essence section of the city center or the area with convenient transportation, even if it is not a new house, it can usually obtain a higher appraisal amount and loan ratio; On the other hand, houses located in the suburbs may have lower housing prices compared to those in the city center, but their living convenience is poor and it is not easy to resell them. Therefore, the bank's appraisal amount and loan ratio are generally lower.

2. Credit conditions: The bank will comprehensively evaluate the credit record of the applicant with financial institutions. If there is no record of delayed payment (such as full payment of credit card fees), or if the applicant has previously applied for other loans with good repayment records, they can usually obtain a higher loan percentage; On the contrary, if there is a record of late payment or debt negotiation, the bank may reduce the loan ratio or even refuse approval. In addition, if the applicant has not applied for a credit card or loan in a financial institution (commonly known as a "credit expert"), due to the lack of transaction records for reference, the bank cannot determine whether the customer can make payments normally, and the credit risk to be borne is relatively high, and the loan disbursement ratio is usually low. Therefore, establishing a good credit record and letting the bank understand your payment habits will help to obtain a higher loan percentage.

3. Occupation and income: Having long-term stable employment and income (such as civil servants or full-time employees of large enterprises), good economic conditions, and abundant savings or investments (such as funds, stocks, real estate, rental income, or fixed-term deposits), represents the applicant's strong repayment ability and has a bonus effect on the bank's evaluation of loan scores.

4. Age: If the applicant is over 55 years old, the bank will consider variables such as their future working years, retirement repayment ability, etc. Usually, the loan amount is also limited.

5. Disgusted facilities: If the purchased house is adjacent to a disliked facility, such as a tomb, funeral home, temple, electric tower, base station, gas station, etc., due to poor housing prices or market liquidity, the bank may also reduce the loan ratio or even refuse to take out a mortgage.

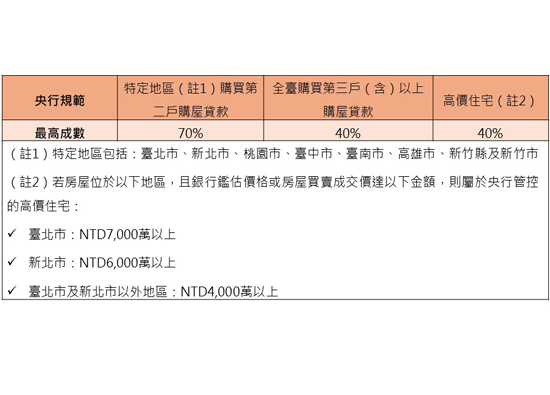

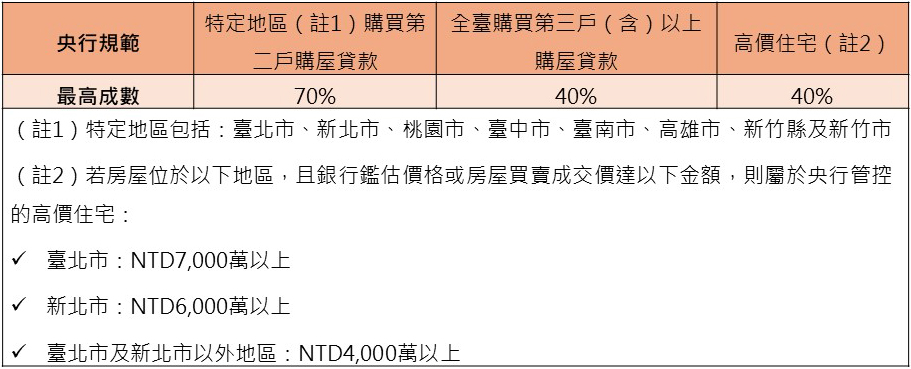

6. Regulatory policies: In recent years, the real estate market has been affected by hot money and investor speculation, leading to a continuous increase in prices. As a result, the government has introduced a policy of "limiting loan quotas". If you purchase a house with a high total price, or if the applicant already has one or more households (including) under their name who have purchased a house loan, the percentage of houses purchased again will be controlled.

3、 How to increase the percentage of mortgage payments

If the bank's loan approval ratio is insufficient, it is recommended to start with the following solutions:

1. Provide guarantor:

If the applicant's credit conditions or repayment ability are weak, they can provide family members with good credit and stable income as insurers, which can help improve the bank's trust and loan success.

2. Find more banks to evaluate:

Intermediaries or builders usually provide fixed cooperating banks, but loan applicants can also seek evaluation from 2-3 banks themselves, especially those with salary transfers or more frequent transactions, because they have long-term transaction records, which can add points to the loan application score. Moreover, the evaluation results of each bank are not the same, so it is worth comparing from multiple sources.

In summary, before purchasing a house, in addition to choosing the desired subject matter, one should also develop a reasonable budget based on their credit history and financial situation. More importantly, they should grasp the key factors that are conducive to loan application, that is, the opportunity to successfully obtain a higher loan percentage and realize their dream of buying a house and starting a family as soon as possible.

Far Eastern International Bank provides preferential housing loans for Far Eastern Group affiliated enterprise employees, with a maximum success rate of 85%. Regular employees must have served for at least six months and provide employee certificates, labor insurance cards, salary statements, employment certificates, and other documents. The housing conditions are all in Zone A of Taiwan (a high-quality area designated by Far Eastern International Bank) and self occupied housing. Qualified applicants are welcome to apply actively.

#