07.2024 Life Guide

Global Financial Market Outlook for the Second Half of 2024

Far Eastern International Bank / Gao Yixun

After the Chairman of the Federal Reserve System, Powell, mentioned the word "interest rate cut" in 2023, the market began a nearly 5-month rise in both stocks and bonds since November. At one point, various sectors expected the Federal Reserve System to cut interest rates by 7 basis points (1.75%, 1 basis point=0.25%) in 2024. However, data shows that there seem to be signs of a rebound in inflation risk in the United States, coupled with the still hot job market, which has led to a conservative attitude in the Federal Reserve System, and has subsequently affected the performance of financial asset prices. This issue of "Finance Column" analyzes the financial market trends in the second half of the year, taking you to grasp important investment information.

After the Chairman of the Federal Reserve System, Powell, mentioned the word "interest rate cut" in 2023, the market began a nearly 5-month rise in both stocks and bonds since November. At one point, various sectors expected the Federal Reserve System to cut interest rates by 7 basis points (1.75%, 1 basis point=0.25%) in 2024. However, data shows that there seem to be signs of a rebound in inflation risk in the United States, coupled with the still hot job market, which has led to a conservative attitude in the Federal Reserve System, and has subsequently affected the performance of financial asset prices. This issue of "Finance Column" analyzes the financial market trends in the second half of the year, taking you to grasp important investment information.Recently, the price performance of various bonds closely related to the monetary policy direction of the Federal Reserve System in the United States has turned sharply, while the stock assets continue to benefit from the AI theme, driven by large electronic stocks such as Nvidia and Meta. Among them, after the 238.87% rise in 2023, Huida's biggest increase in 2024 has reached 97.23%. Investors began to worry about whether the AI theme is in the stage of foam like the Internet craze in 2000.

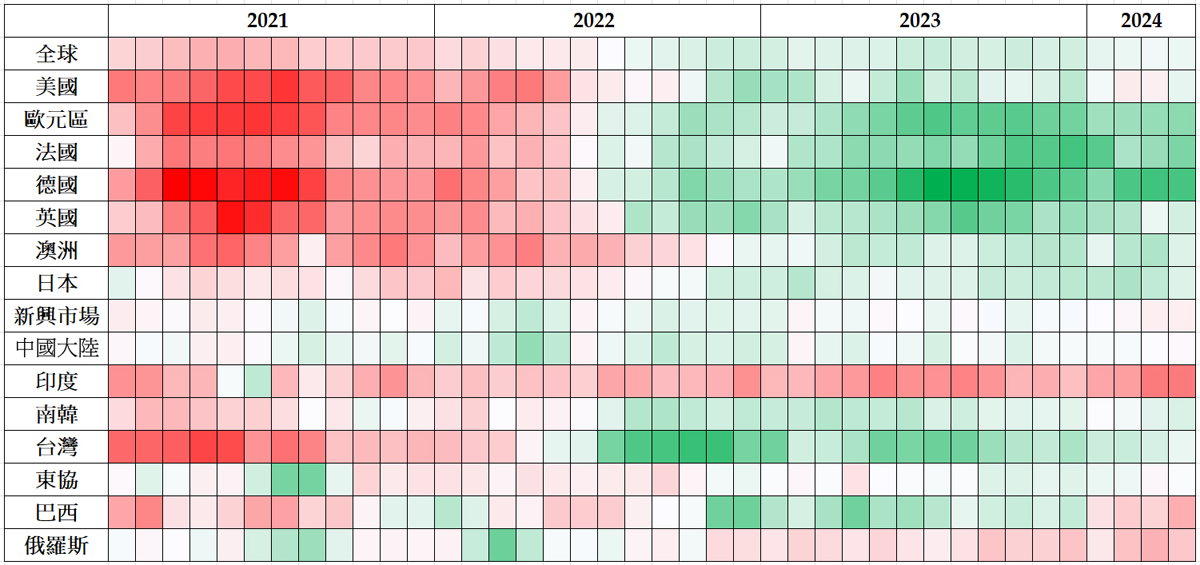

Table 1: Global Stock and Bond Index Performance in 2023 and January April 2024

Source: StockQ.com, May 1, 2024

Source: StockQ.com, May 1, 2024On the other hand, international stock markets have been affected by the following bearish news, and since late March, the upward momentum has gradually slowed down:

1. Tensions in the Middle East are escalating: Iran launched missiles and drones against Israel in retaliation for the bombing of the Syrian embassy in early April. It was reported that Israel retaliated with missiles a few days later, but was later denied by Iranian state media in an attempt to prevent the conflict from escalating.

2. Japan's 2024 salary increase: The results of Japan's labor annual salary negotiations have been released, with a new high of 5.3% in 2024. The Bank of Japan is expected to abandon its monetary policy of negative interest rates.

3. The expected performance of heavyweight enterprises remains unchanged: The first quarter financial report of heavyweight enterprises was significantly better than market expectations, but did not surprise the entire market in terms of enterprise outlook.

In the second half of 2024, the global economy will experience stable growth, with continuous inflation and geopolitical issues

Starting from the second quarter of 2024, financial market volatility has been more severe than in previous quarters. Although interference factors are difficult to disappear in a short period of time, the global economy and corporate physique are gradually improving. According to the I/B/E/S survey, as of the first quarter of 2024, Magnificent 7 (including Pfizer, Google, Amazon, Meta, Apple, Tesla, and Netflix) saw significant growth in profits, driving the overall S&P 500 constant stock company from loss to profit. In the following quarters, as Magnificent 7's profits show double-digit growth, the profit growth of the other 493 companies will also increase quarter by quarter, taking over as another driver of the S&P 500 index.

1. The opportunity for the economy not to land is increasing

Since the beginning of 2023, the financial market has been filled with a conservative atmosphere, especially after the Federal Reserve System's violent interest rate hikes, investors expect the global economy to fall into recession. Observing the Purchasing Managers Index (PMI) of major global economic systems, 2023 was a period of green energy, with European countries experiencing particularly significant economic slowdown, and the manufacturing industry continuing to decline as expected by the market. However, even if the war between Ukraine and Russia continues, the momentum of economic growth in Chinese Mainland has slowed down under the impact of the real estate storm. The global economy still has some room from recession, and the possibility of a soft landing (the economy will not decline, and inflation will slowly slide to the central bank's target area) is slowly increasing.

Figure 1: Manufacturing Purchasing Managers Index of Major Global Economies from January 2020 to April 2024

Source: Bloomberg, May 2024

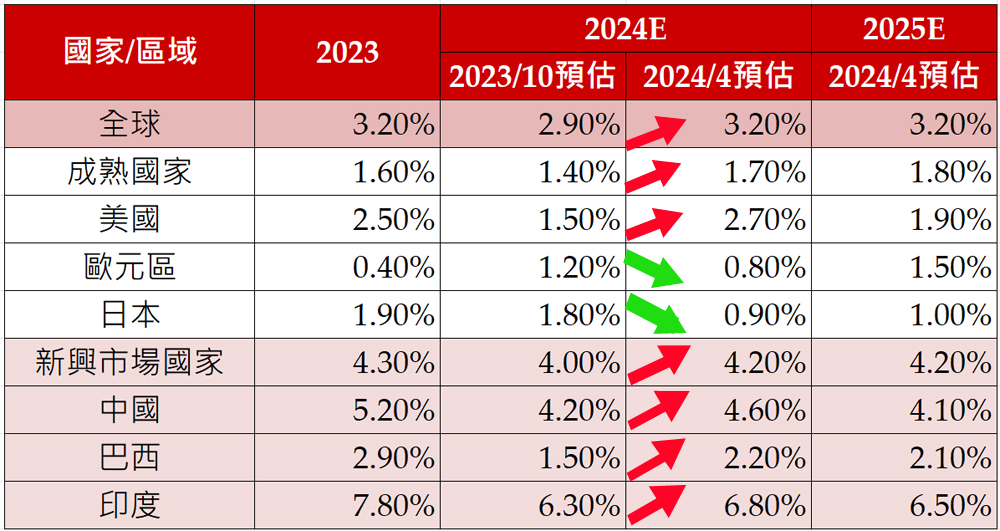

Source: Bloomberg, May 2024Moreover, data from the International Monetary Fund (IMF) and the Organization for Economic Co operation and Development (OECD) indicate that the global economy may not necessarily be a soft landing, but rather a non landing (the economy will not decline, and inflation will be higher than the central bank's target zone). The IMF released its global economic outlook forecast in April 2024. Due to strong economic performance in the United States and some emerging market countries, the global economic growth rate has been raised from 2.90% to 3.20% this year, with most major regions or countries receiving an upward revision. At the same time, in early May, the OECD also raised its global economic growth forecast for this year, considering the strong recovery of the US economy and the better economic situation in China compared to the fourth quarter of 2023, reflecting that the global economic landscape has changed significantly from six months ago. In addition, both the IMF and OECD have specifically mentioned the risk of inflation, as prices may take more time to slowly return to the central bank's target.

Table 2: International Monetary Fund (IMF) Global Economic Growth Rate Estimates

Source: IMF, April 4, 2024. Explanation: 2023 is the actual value, while 2024 and 2025 are estimated values

2. Limited space for central banks of various countries to relax their monetary policies

With the efforts of the central bank, the risk of global inflation has indeed been controlled to a considerable extent. Although victory is in sight, the rebound in the first quarter of this year has made decision-makers hesitant to slack off. On the one hand, due to the resilience of the economy and job market, the impact of inflation on US consumption is not significant; On the other hand, the warming situation in the Middle East, the strengthening of the Chinese economy, and the increasing demand for green energy have respectively driven up international oil and copper prices. The CRB commodity index (a commodity futures price index compiled by the US Bureau of Commodity Research) rose by 12.35% from January to April 2024, adding a lot of fuel to inflation. Therefore, after the Federal Reserve System monetary policy meeting in May, Chairman Powell stated that the possibility of raising interest rates was low, and the portion of interest rate cuts was difficult to determine the timing due to uncertainty about whether inflation could move towards the 2% target. The market has also adjusted its estimates one after another, believing that the rate cut this year will be revised down to 2-3 yards, and the earliest point of rate cut may be postponed to September.

Even though the European Central Bank has announced a rate cut in June, decision-makers have hinted in their conversations that meetings after June may not necessarily cut rates, indicating that inflation is still a pain in the hearts of central banks around the world, and even emerging market countries need to raise interest rates to suppress inflation.

3. If Israel does not stop, geopolitical risks will not easily cool down

After the Israeli Palestinian conflict in October 2023, neighboring countries such as Lebanon, Syria, and even Yemen radical organizations and Iran have participated in military activities, causing tension in the Middle East. Fortunately, under the moral persuasion of countries such as Britain and the United States, conflicts are still controlled within a certain range. Although various countries have hoped for a ceasefire in Israel through diplomatic channels, it has not been effective. Therefore, even if the short-term conflict cools down, the overall situation in the Middle East remains unstable, which is an unexploded bomb for global financial markets. On the other hand, the conflict between Ukraine and Russia continues, but the scope and scale of the conflict have not expanded, and the impact on financial markets is limited.

4. AI themes are starting to take off

The MSCI ACWI IMI Robotics&AI Index rose by 57.59% in 2023 and an additional 12.35% in the first three months of 2024, let alone the largest weighted stock in the index, Huida (accounting for 7.53% of the index weight), which has risen by 518% from March 2023 to March 2024. In just 15 months, the index has surged by nearly 70%, which inevitably raises doubts about whether the AI theme has reached its end. In fact, compared to 5G, AI applications have gradually expanded to various industries. Although current AI does not yet have conscious judgment and decision-making, and relies on vast databases and computing power training, it is sufficient to solve many problems in enterprises, factories, and people's lives.

The algorithms used in AI models are becoming increasingly advanced, and the hardware is also keeping up with the times. At present, AI chips use 5-nanometer process technology, which is very energy-efficient to operate. Wafer foundries continue to develop advanced processes such as 3-nanometer and 2-nanometer to accelerate computing power while reducing the demand for electricity. Not only will chips continue to innovate, but peripheral components such as servers, server racks, data centers, network devices, and heat dissipation will also benefit from the development of AI, just like smartphones becoming smaller and more functional, and their application levels becoming more and more widespread. Perhaps AI leading stocks may need to take a break after experiencing high growth in the past year, but the theme of AI has just begun.

Is the US presidential election a blessing or a curse?

The 47th presidential election will be held in November 2024 in the United States. Biden and Trump have obtained enough party representative votes and will participate in the presidential election on behalf of the Democratic Party and the Republican Party respectively. This competitive combination is the same as four years ago, and there is no significant difference in the political views proposed by both camps in the party primaries compared to four years ago. According to the poll results completed in succession since February, most of Trump leads, but since April, Biden's support has slowly rebounded. Even after Iran attacked Israel, the support has risen rapidly, on a par with Trump, and the proportion of swing states even leads in some polls. Due to the fluctuating popularity of polls, it is not easy to predict who will win. Based on the performance of the US stock market after past elections, it seems unfair to estimate the market situation after this year's elections, as the economic and international political environment are vastly different. What impact will it have on the financial market in the future requires a more comprehensive political perspective.

Disclosure and Disclaimer: This article is compiled and analyzed based on the information obtained, and does not guarantee the completeness and accuracy of all information. Part of the content contains forward-looking statements, such as "possible, will, expected, should, expected, expected, predicted, estimated, planned, ongoing" or "believe, believe" or similar words. Although these expectations and assumptions are reasonable, they should not be considered necessarily credible; Due to the existence of various risks or uncertainties, actual performance may deviate significantly from the contradictions shown or implied in the forward-looking statements. Therefore, this article should not be regarded as an offer or inducement to buy or sell securities or other financial products.

#