07.2025 Life Guide

The Heartwarming 'Buddhist Financial Management Technique'

Far Eastern International Bank / Xie Mingrong

There is a way of financial management where investors continue to participate in the market with small amounts, accumulating abundant results over time. This seemingly 'Buddhist style' and laissez faire approach to financial management may have a higher success rate after data backtesting. If you frequently enter and exit the market but find nothing, you may refer to the method introduced in this issue's "Finance Column".

There is a way of financial management where investors continue to participate in the market with small amounts, accumulating abundant results over time. This seemingly 'Buddhist style' and laissez faire approach to financial management may have a higher success rate after data backtesting. If you frequently enter and exit the market but find nothing, you may refer to the method introduced in this issue's "Finance Column".In the famous opera "Peach Blossom Fan" by Yuan Dynasty scholar Kong Shangren, there is a line of lyrics that goes: "Watching him rise from a high-rise building, watching him entertain guests, watching his building collapse." This perfectly describes the phenomenon of stock investors chasing after skyrocketing stocks in recent years, from overnight wealth to instant capsizing and even losses. Surfing in the sea of stocks can satisfy pleasure, and standing on the waves with luck can enjoy highlights, but it may not necessarily help accumulate wealth.

Investors are usually their biggest enemies

Dalbar (Dalbar, Inc.) has been researching investor behavior for a long time. Since 1984, it has published the "Quantitative Analysis of Annual Investor Behavior" (QAIB) every year, with the aim of enhancing portfolio performance through investor behavior management. According to its long-term data analysis, investors are usually their biggest enemies, and their main erroneous behaviors include short-term trading, chasing high and killing low, and lack of discipline. In short, investors are easily affected by market fluctuations and excessively frequent redemptions, thereby reducing long-term returns.

Emotional reactions may reduce returns

The latest report by Dalbar in 2024 points out that investment results are more influenced by investor behavior rather than the returns of the fund itself. Compared to investors who are influenced by personal emotions, those who are patient and not fixated on short-term market fluctuations are more likely to successfully accumulate wealth.

Dalbar analyzed the 30-year performance of the US S&P 500 index and compared it with the average return of US stock fund investors. It was found that investor returns were lower than the index performance (the annualized return of the index was 9.7%, while investors only earned an average of 6%), especially if they missed the highest range of gains, the return rate was even worse. Why do investors miss the highest range of gains? There are two main reasons. Firstly, investors rush out of the market when they see a sharp drop, missing out on the rebound after the drop; The second reason is that investors see a surge in prices and redeem early, resulting in missing the opportunity for the market to continue to rise.

Compared to God, investing in discipline is the key

Most people prefer to pursue the god operation that claims to bet on soaring stocks, but ignore the long-term investment success rate and the ultimate wealth accumulation results. True victory mostly comes from plain and unadorned continuous investment and accumulation, being a calm and self disciplined investor amidst the clamor. The 'Regular Fixed Investment Fund' can help you achieve this goal by continuously rolling into the market with small amounts, participating in market growth, and at the same time, entering at different times may also spread costs and eliminate uncertain factors of market fluctuations. For novice investors or those who don't have time to delve into investment targets, it can be considered the best solution.

The earlier you start, the better the effect

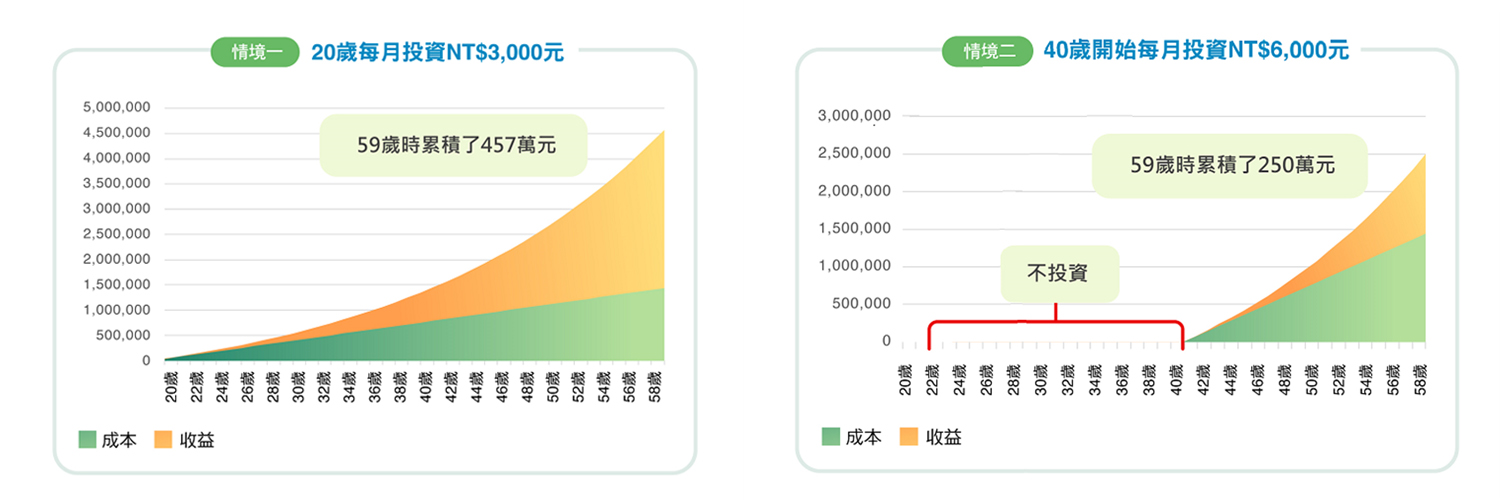

There are many techniques for regular fixed investment, among which the most important is to extend the time and amplify the returns. Taking the following image as an example:

Starting from the age of 20, invest NTD 3000 per month in a commodity with an annualized return rate of 5%. At the age of 59, the sum of principal and profit was NTD 4.57 million, the cost was NTD 1.44 million, and the yield was 217%.

Starting from the age of 40, B invests NTD 6000 per month in a commodity with an annualized return rate of 5%. At the age of 59, the sum of principal and profit was NTD 2.5 million, the cost was NTD 1.44 million, and the yield was 74%.

As can be seen from the above, for the same total investment cost and commodity, the yield difference can be as high as three times due to the compounding effect over time.

Table 1: Two Scenarios, Two Fates

Data source: Far Eastern International Bank, data date: September 2024. The above is the result of simulating investment portfolios based on historical data. The data is for reference only and does not represent the actual return rate or future performance guarantee of this investment portfolio, nor does it consider the impact of inflation for the time being.

Data source: Far Eastern International Bank, data date: September 2024. The above is the result of simulating investment portfolios based on historical data. The data is for reference only and does not represent the actual return rate or future performance guarantee of this investment portfolio, nor does it consider the impact of inflation for the time being.Starting from oneself, slow wealth can also become the 'rich generation'

According to the "National Wealth Statistics" by the Directorate General of Budget, Accounting and Statistics, the distribution of household assets in Taiwan in 2021 showed that the assets of the top 20% of households (Figure 1) were 66 times that of the bottom 20% of households (NTD 51.33 million for the former and NTD 770000 for the latter), with a difference of only 16.8 times compared to 1991, indicating a more pronounced trend of "the rich getting richer". Further analysis of the composition of household assets reveals that there is a significant gap in financial assets such as savings, stocks, and funds. The top 20% of households have an average NTD of 38.09 million, while the bottom 20% have an average NTD of 2.22 million, a gap of 17 times. In the real estate sector, the top 20% of households have an average NTD of 14.8 million, while the bottom 20% have an NTD of 2.24 million, a difference of six times.

From this, it can be seen that the reason for the continuous appreciation of wealthy people's assets comes from financial assets, and "wealth management" is the biggest reason for widening the gap. Financial management is like rolling a snowball, the longer the time, the bigger the snowball. In other words, disciplined investment is the important driving force for "money rolling", just like the ancestral motto of the European Rothschild family, which has been passed down for seven generations and is one of the top ten richest families in the world: "Success comes from long-term persistence and attention".

Figure 1: 30 Years of Family Wealth Gap in Taiwan

Household assets "=" non-financial assets+financial assets - financial liabilities ", data source: Directorate General of Budget, Accounting and Statistics, statistics up to 2022.

Household assets "=" non-financial assets+financial assets - financial liabilities ", data source: Directorate General of Budget, Accounting and Statistics, statistics up to 2022.Salary can't beat the stock market. If you don't manage your finances, they won't care about you

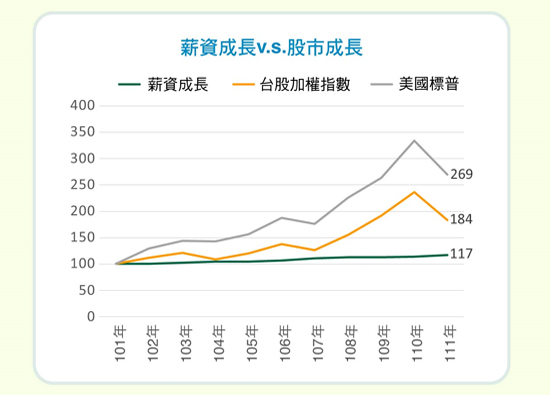

The warning that 'investment must have risks' is well-known to the public, but if it is understood in reverse as' no investment, no risk', it may not be true. The biggest risk of not investing, apart from wealth shrinking due to inflation, is not keeping up with the market driven wealth appreciation and gradually distancing oneself from others. According to statistics from the Directorate General of Budget, Accounting and Statistics, the average annual salary for employed employees was NTD 442000 in 2012 and NTD 518000 in 2022, with a ten-year increase of 17.19%. Within the same range, the Taiwan stock market rose 83.62% and the US stock market rose 169.21%. Further observation shows that 2019-2021 was the top three years for most stock markets, with gains of 60-70% for both Taiwan and US stocks. Even if they were to pull back and correct by 20% in 2022, the overall trend would still be upward. In other words, if you stick to your salary and expect to increase your total assets through annual salary adjustments or job hopping, your neighbor may have already taken advantage of the bullish period by investing and slowly widening the gap with you.

Figure 2: Salary Growth vs. Stock Market Growth

Small scale regular participation in the market and joining the wealth management community

Small scale regular participation in the market and joining the wealth management communityRefusing to let assets fall behind means participating in the market intelligently. It doesn't matter if you don't have a rich dad. Regular fixed investments can be rolled into the market with small amounts, and as long as you continue to invest with discipline, you also have the opportunity to accumulate considerable assets.

Far Eastern International Bank shares on the podcast "Ten Joys in Life without Money", establishing disciplined financial management through the "Dream Calculation Table" and experiencing the charm of the "Slow Wealth and Happy Life" investment philosophy. Welcome to scan the QR code to listen to the program S1-EP5 "Take it slow, take it fast~The new investment philosophy of Slow Fuluohuo".

※ Investment always carries risks, and fund investment can be profitable or unprofitable. Before subscribing, it is necessary to carefully read the prospectus (investor notice)