03.2025 Life Guide

The stock market is expected to reach a new high in 2025, the year of economic recovery

Oriental Petrochemical (Taiwan) Investment Advisor / Xie Yifan

In 2024, the global demand for consumer electronics is generally lower than expected due to the high interest rate environment, and the automotive market is also slowing down. But due to the continuation of the AI wave, major manufacturers are competing to expand capital expenditures, and the growth momentum of related supply chains is strong. Taiwan is a major supply chain partner, benefiting greatly and driving significant GDP growth in 2024. It is expected that after Trump becomes the president of the United States again in 2025 and the world officially enters the interest rate reduction cycle, in addition to AI, the market is still the focus of observation, and the weak consumer electronics in the past is also expected to usher in recovery.

In 2024, the global demand for consumer electronics is generally lower than expected due to the high interest rate environment, and the automotive market is also slowing down. But due to the continuation of the AI wave, major manufacturers are competing to expand capital expenditures, and the growth momentum of related supply chains is strong. Taiwan is a major supply chain partner, benefiting greatly and driving significant GDP growth in 2024. It is expected that after Trump becomes the president of the United States again in 2025 and the world officially enters the interest rate reduction cycle, in addition to AI, the market is still the focus of observation, and the weak consumer electronics in the past is also expected to usher in recovery.Entering a cycle of interest rate cuts by 2025, the global economy is growing steadily

In the context of maintaining low inventory of general consumer electronics worldwide by 2025, with the expansion of AI applications and the economy entering a cycle of interest rate cuts, there is a chance for consumer electronics to recover. Demand will be driven by the service industry in the manufacturing industry, and the economic growth rate is expected to be maintained.

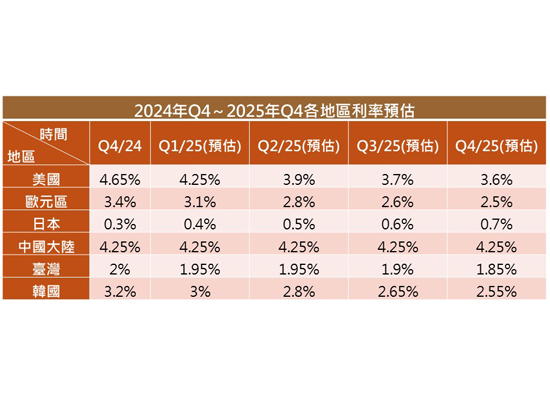

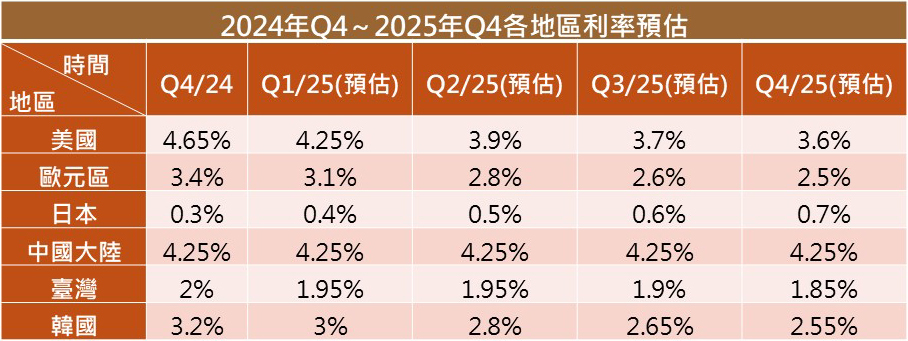

In addition, in 2025, except for Japan's unchanged inclination towards interest rate hikes, interest rates in major countries around the world are expected to continue to decline. Loose monetary policies and increased incentives for corporate investment are expected to drive industrial recovery and stimulate consumption.

In addition, in 2025, except for Japan's unchanged inclination towards interest rate hikes, interest rates in major countries around the world are expected to continue to decline. Loose monetary policies and increased incentives for corporate investment are expected to drive industrial recovery and stimulate consumption.Trump used to adopt "expansionary fiscal policy" to stimulate the economy. With the start of the interest rate reduction cycle, according to the model of the Federal Budget Accountability Committee (CRFB) for debt sustainability, if the long-term bond yield of the United States is maintained at about 4%, the debt interest cost is still controllable.

Chuanliu whirlwind: Republican complete governance benefits stock market

Trump's election as President of the United States has eliminated a variable in the international financial market. According to the impact of the past U.S. election results on the stock market, when the Republican candidate is elected as President, the Congress of the same party is in full power, and political parties rotate, the U.S. stock market is usually the strongest in the quarter after the election.

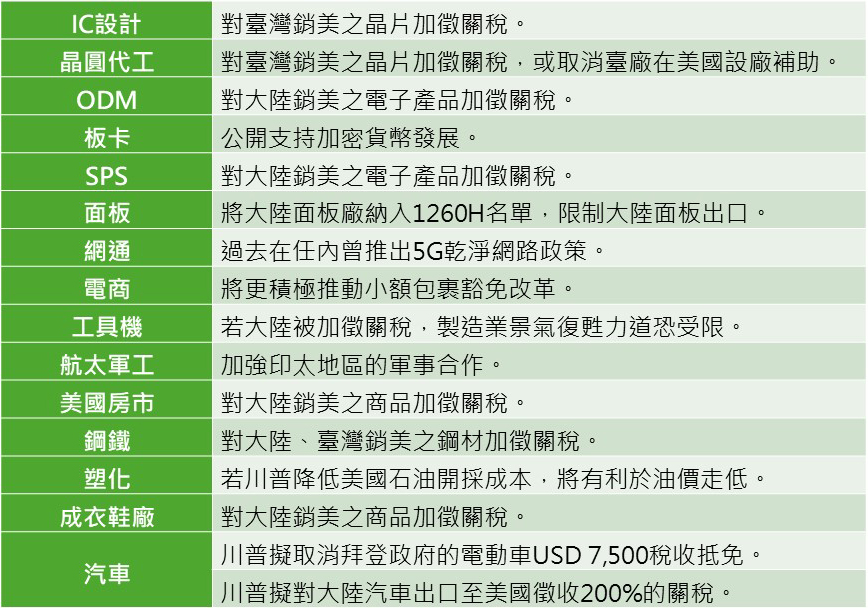

Chuanliu whirlwind: policy shift, rise of a new wave of mainstream stocks

Chuanliu whirlwind: policy shift, rise of a new wave of mainstream stocksAfter political interference is eliminated, investment focus returns to fundamentals. Trump's first two policies of tax reduction and tariff increase are highly likely to be implemented, and it is expected that a wave of "stream tornado" will blow in the market.

2025 is still a year of risks and opportunities coexisting

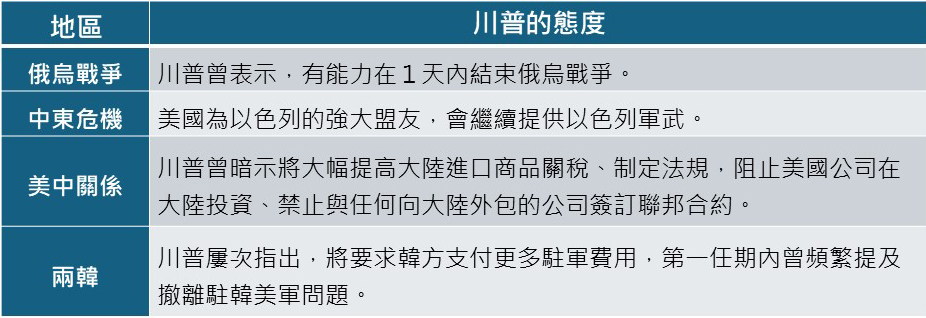

2025 is still a year of risks and opportunities coexistingIn addition to the above opportunities, the biggest risk brought by Trump's inauguration is still geopolitical. Although he did not provide specific details of foreign policy during the election period, based on his past statements, it is speculated that the Russia Ukraine war is expected to end soon, but the Middle East crisis will continue to expand, and the impact on inflation will be further exacerbated. The relationship between the two sides of the Taiwan Strait and the United States will be the focus of future market observations.

2025 Wind Direction Ball

Despite the high interest rate policy adopted by the United States to curb inflation, consumer spending remains strong. In the latest World Economic Outlook report, the IMF raised its economic growth forecasts for the United States in 2024 and 2025 to 2.8% and 2.2% respectively, mainly due to rising wages and asset prices, which have driven consumption growth higher than expected. In addition, the global GDP growth is expected to be 3.2% in 2024, and there is a chance for the global economic growth rate to remain at 3.2% in 2025. With the base period rising and the economy continuing to recover, it will maintain a growth rate higher than the average.

In terms of investment direction, AI remains the main driving force for technology stocks to make profits. In addition, the market expects the annual profit growth rate of enterprises to be above double digits in 2025, higher than 2024. If the profit margin expands, the general consumer electronics, automotive, and internet communication industries are also expected to usher in a recovery opportunity.

#